We’re all looking for signs of sufficient improvement in market sentiment that suggest we have reached that inflection point when we know the worst is behind us and something like normalcy is ahead.

Of all of the major markets that contribute to the official VIP Hospitality industry, China was the first to be affected by the coronavirus so, logically, would be the first to hit that inflection point.

That’s why market-watchers are looking for signs of what in China is called 报复性消费 or Revenge Buying.

And the first sign of Revenge Buying may just have dropped this past Saturday: The flagship Hermès store in the southern Chinese city of Guangzhou is said to have generated at least 19 million renminbi, or $2.7 million, in sales on the day of its reopening.

The single-day tally is believed to be the highest for a boutique in China. https://t.co/AFc8BKaXN2

— WWD (@wwd) April 13, 2020

If true – and Hermès have not confirmed the figure – that would be the biggest one-day result ever for a single luxury boutique in China. That there was something like a shopping frenzy can be confirmed by the pictures taken from inside the story by invited VIPs that were published to Chinese social media platforms.

So what is Revenge Buying? The term was first coined in the 1980s when the specific reference was to the ‘pent up demand for foreign products that had been denied [to China’s] citizens when the nation was closed off to the outside world’, according to Business of Fashion.

More recently the term is being used across Chinese social media to describe how ordinary citizens are dreaming of treating themselves once quarantine is lifted.

And related to Revenge Buying is the concept of Revenge Travelling (报复性旅游), all of those trips that people have either had booked but had to cancel because of the coronavirus, or have been dreaming of while in the confines of state-enforced lockdown.

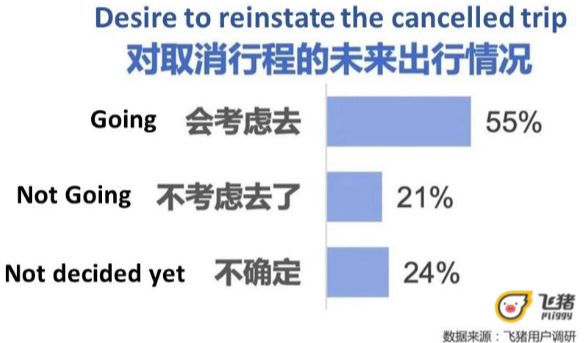

In a recent article for Travel Daily Media Anita Chan, CEO of Compass Edge shared a number of revealing surveys:- According to Fliggy, Alibaba’s online travel platform, more than half of those surveyed who had booked and then cancelled their trips due to the coronavirus will reinstate those trips, with almost a quarter still undecided;

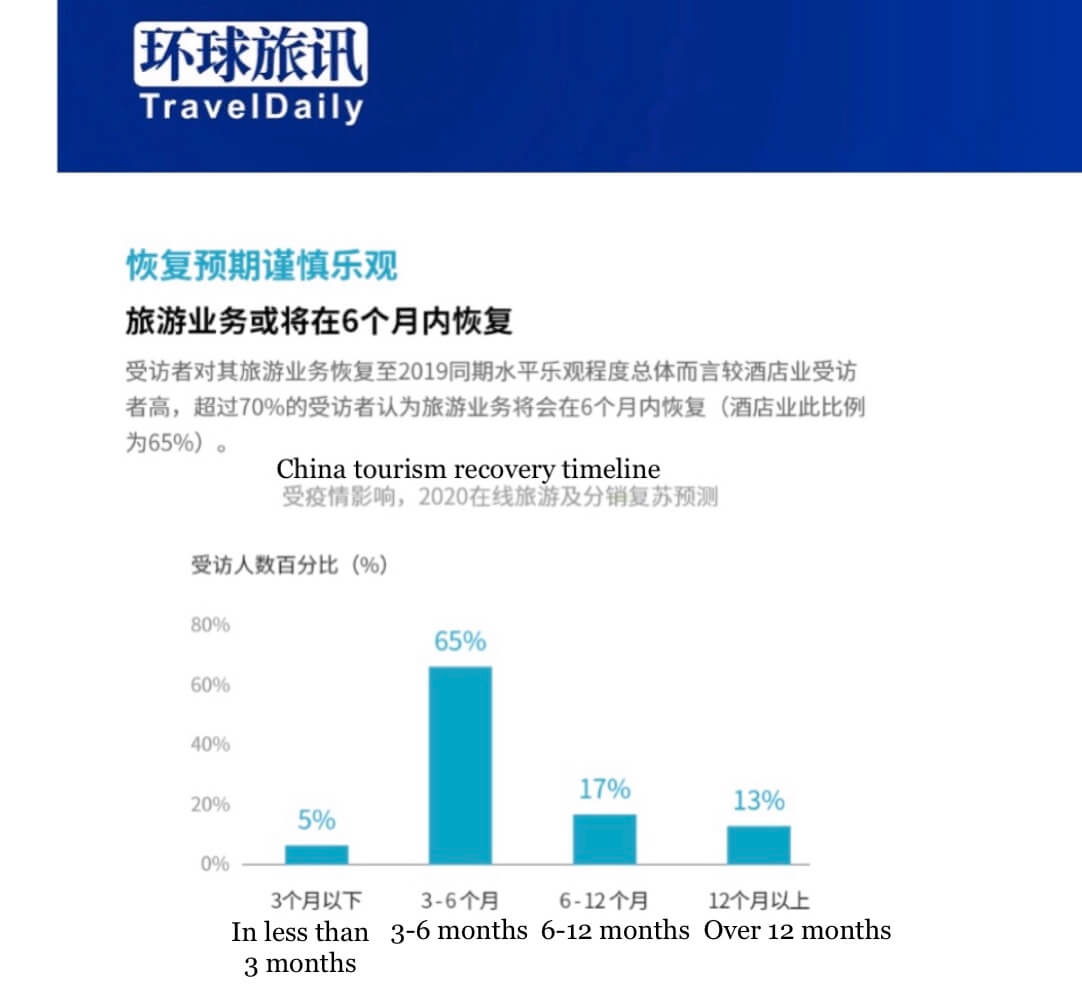

- An extensive Travel Daily survey showed that almost two-thirds of those travel professionals contacted believed the China market will have recovered within 3-6 months;

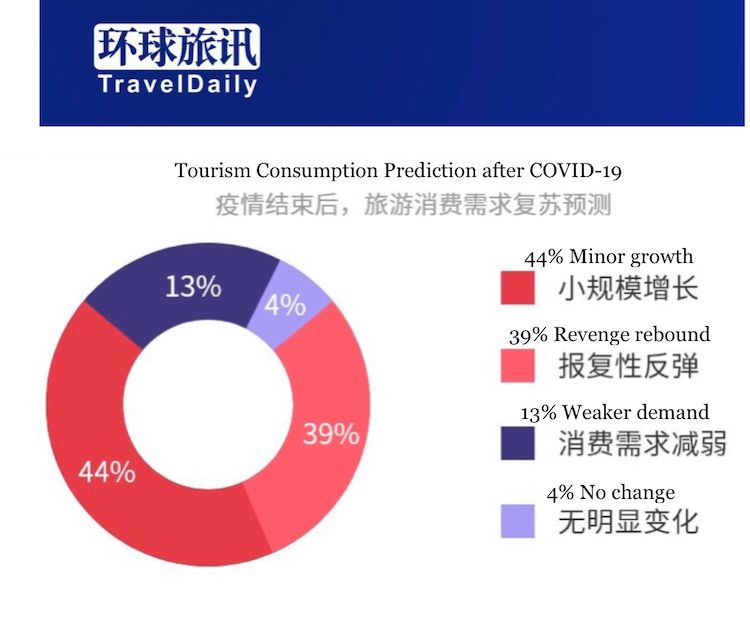

- In that same survey, nearly two in five of those surveyed saw the spending profile of that recovery being a ‘revenge rebound’, ie the sort of sharp spending seen in the Hermès store in Guangzhou.

What is at play here?

Although this is a 2017 video, prepared for the 2018 EU-China Tourism Year by the European Tourism Association, it contains same fascinating consumer trends that are emerging from the outbound China market. The presentation is made by the chief marketing officer of ForwardKeys, a data analytics company that specialises in extracting profitable insights from the tens of millions of travel bookings made daily [in a normal year].

Photo by Mitchell Luo / Unsplash