Live Nation is the vertically-integrated colossus within the music and entertainment side of the Live Event industry [full disclosure, DAIMANI is an appointed sales agent of Live Nation’s official VIP Hospitality packages for a number of concerts and festivals].

With the New York Stock Exchange ticker LYV, the company is a component of the S&P 500 and was founded in 2010, following the merger of promoters Live Nation and Ticketmaster. The company promotes, operates, and manages ticket sales for live entertainment in the United States and internationally, as well as owning and operating entertainment venues, and managing the careers of music artists.

The venues and festivals under their management or in which they have an investment stake include London’s Queen Elizabeth Olympic Park and 3Arena in Ireland as well as the Download Festival in Melbourne, Australia, the Rhythm and Vines Festival in New Zealand, and the Wireless Festival in London.

So when Live Nation reports their 2020 Q1 results, which they did overnight, the rest of the Live Event industry leans forward to listen. What Live Nation foresees in their vertical areas of entertainment knowledge is probably what the rest of us are seeing or going to see some time soon.

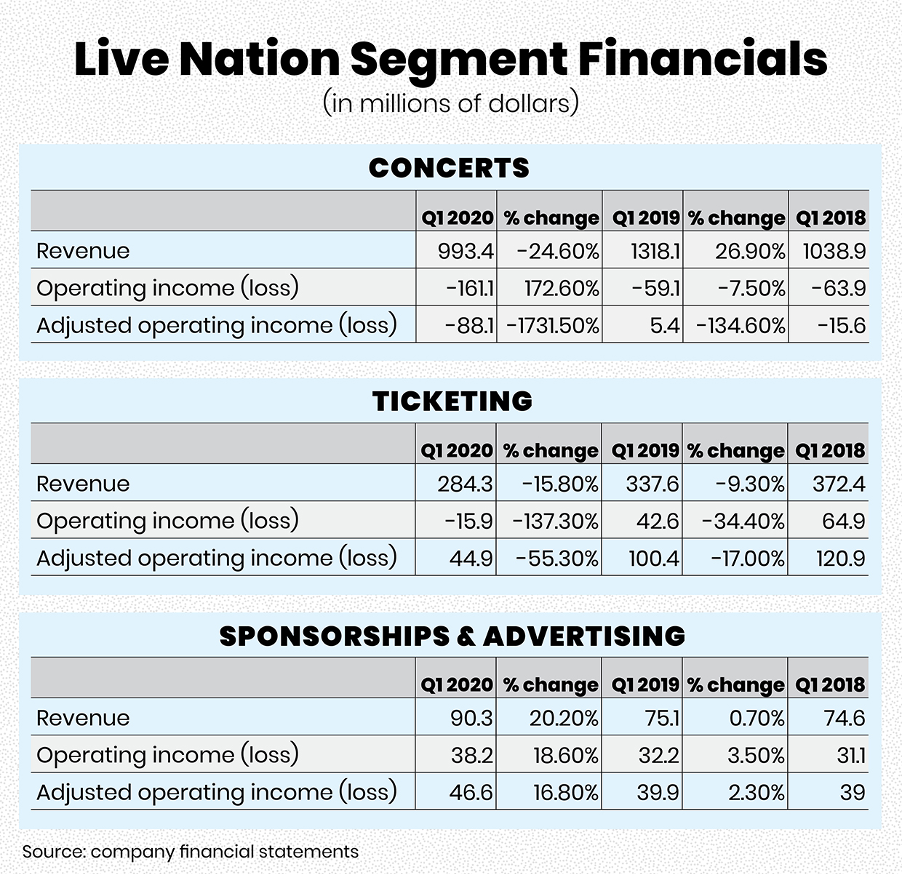

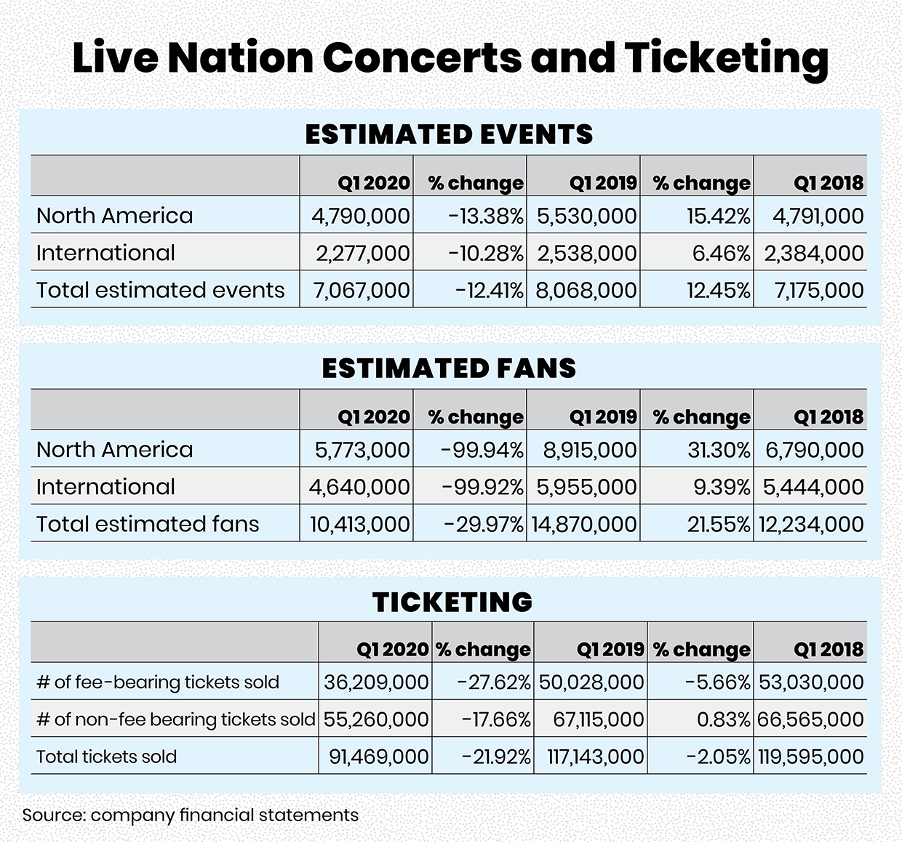

Compared to Q1 2019, concert revenue dropped 24.6% and ticketing revenue fell 15.8% [remember the coronavirus lockdowns started towards the backend of Q1].

The mood from Live Nation’s leadership team was positive but cautious about the challenges ahead. ‘We don't want to rush,’ said CEO Michael Rapino. ‘We're playing long ball.’

We have reproduced below some of the topline information. But the detailed ‘investor’ information can be accessed here, including their earnings webcast.

The good people at the entertainment bible Billboard were good enough to extract some of the key lessons from Live Nations’ results and we share these with you below.

Q2 and Q3 are all about small events, not large tours

Nothing was said during the earnings call that suggests Live Nation's leadership team believes concerts will return at scale in 2020. Speaking about the 2020 timeline, [CEO of Live Nation Entertainment Michael] Rapino said Live Nation's goal is ‘to be ready to be on sale in Q1 for '21 at full scale.’ In the more immediate future, he said the company will be ‘testing’ new ideas ‘throughout the summer'.

Talking about booking postponed shows in 2021, Rapino said the company will have a ‘robust '21 backend and [a] robust '21-'22.’ [Live Nation Entertainment president Joe] Berchtold said it's ‘not our expectation to have a huge volume of shows this year.’ Entering Q4, ticketing and sponsorship revenue will pick up from ticket sales for ‘some large scale’ for events next year, said Berchtold.

The rest of 2020 is about experimentation, not headcount

Rapino said ‘in the next six months’ Live Nation will host concerts ‘focusing on the basics’ and testing new concepts, rather than roll out tours with venues at full capacity. He said Live Nation is considering opening theatres and arenas with just 20 percent of capacity, but the economic feasibility of such low-attendance events was not discussed. The company is testing concerts at drive-in theatres, which seem suitable for holding concerts with low transmission risk, but again few details were given. And it will ‘dabble in fan-less concerts’ that have ‘great broadcast opportunities,’ and can provide sponsorship revenue, he said.

Rapino mentioned fanless concerts streaming online (‘we can make the math work’), drive-in theatre concerts, ‘reduced capacity festival,’ outdoor concerts, concerts in theatres and ‘a large stadium floor where there's enough room to be safe.’ Come fall, concerts will have ‘more of a theatre setting’ and some be in arenas.

Ticketing and sponsorship revenue in 2020

It is expected that Ticketmaster, a high-margin division, will generate ticketing revenue in Q3 and Q4 as tours go on sale for 2021 - and help Live Nation's lucrative sponsorship & advertising division.

Live Nation has ample liquidity for multiple scenarios

Monthly cash burn is US$ 150 million, according to Joe Berchtold, Live Nation's president. As of March 31, Live Nation had US$ 807 million and $900 million available in a revolving credit facility. ‘So that says you can go through this year without doing any shows on any scale without any concern,’ he said. But it's clear Live Nation does plan on having concerts in 2020, so there will be revenue opportunities. And deals in 2020 will require some cash for advances to artists. However, as mentioned above, Live Nation is shifting some cash paid to artists out of 2020 and into 2021.

In addition, Berchtold said access to more borrowing means Live Nation will consider additional liquidity ‘opportunistically.’

[Separately Deadline reported that Live Nation Entertainment would be seeking US$ 800m in fresh cash through the sale of corporate debt.]

Cash advances paid to artists are being reduced or deferred to next year

The company had previously mentioned these cash savings when announcing its plan to reduce expenses and cash outlays by US$ 500 million in 2020. Over the next six to 12 months, Live Nation will sign deals that offload some of the financial risks to artists ‘to get shows back on the road’ and ‘get back, scale fast but not have to worry about losing money on the show.’

Debt covenants won't be a problem

Lenders set up guard rails that require companies to maintain a minimum amount of earnings. CFO Kathy Willard said Live Nation ‘absolutely will not break out covenants’ in the scenario there is no ‘material’ concert activity but some ticket sales and corresponding sponsorship revenue. Again, Live Nation is prepared for a slow 2020 and appears to be focused on 2021.

Fans want to feel safe at concerts

Live Nation conducted an online survey of people who have purchased a ticket from Ticketmaster in the last 12 months (for concerts, festivals, sports, arts & theatre and family). The findings jibe with the insights from the latest MRC Data survey, which found that 61% of respondents want hand sanitiser placed throughout venues. As well, 51% of people need an open-air venue to feel comfortable to attend a live event.

What's the new normal? Nobody knows

Since the pandemic is uncharted territory for all stakeholders, nobody knows the exact path forward or what exists at the end of the road. People know what they don't know: when tours might resume, what health precautions will be taken. And they don't know what they don't know, meaning unexpected problems and outcomes are certain to arise.

Last week Joe Berchtold, Live Nation Entertainment’s president, was interviewed on CNBC and asked to look into the future.

You will note his confidence about the ‘bouncebackability’ of the Live Event industry – that 90% of 10,000 fans polled were eager to attend music and entertainment Live Events and 80 percent wanted to do so in the next four months.

The survey that Berchtold references can be downloaded here.

Some of the findings are fascinating and well worth spending time to digest.

This video shows Berchtold on Squawk Alley on May 8, just under a week before the Q1 results were released, but talking about those same Live Event lockdown issues.