Who are the eight investment companies that made the deal happen; what was the 'Kill' fee, and how long is eBay's non-compete?

Lodged on the ‘EDGAR’ search engine of the Securities and Exchange Commission’s website is what the SEC describes as the ‘execution version’ of the stock purchase agreement that frames eBay’s sale of their wholly-owned StubHub secondary ticket platform to archrivals Viagogo.

To the best of our knowledge at The DAIMANI Journal, this document has not been in the media before. And because we have this from the SEC site direct, it’s reasonable to assume it is the genuine article.

It took us about four hours and three full pots of coffee to comb through the 100-plus pages by which time we were really cranked up. So if there are any errors or inexactitudes in our analysis, please put it down to that.

The headline facts are already well known, specifically that the two key Viagogo entities, both Delaware-registered, PUG LLC and its parent Pugnacious Endeavors Inc have acquired StubHub from eBay for US$ 4.05 billion in cash. The Schedules to the agreement are not included in this SEC document but StubHub is the ‘Transferred Company’ referred to, along with, collectively, the ‘Transferred Companies’, the various StubHub entities around the world.

It’s more than one hundred pages long, so please take your time to read through, and draw your own conclusions.

At the heart of the transaction are the following:

The Seller - eBay Inc. and eBay International AG, and The Purchaser, PUG LCC with the ‘Purchaser Guarantor’ being Pugnacious Endeavors Inc. The signature version lists the interim CEO of eBay and a director of eBay International AG, and Mark Streams as President of PUG LLC and as general counsel of Pugnacious Endeavors Inc.

So here are some of the interesting points that jumped out at us:

1. The Guarantors:

Listed in the agreement are eight companies, but in four ownership clusters, who are Guarantors to the whole sales agreement ‘guaranteeing the performance and payment of certain of Purchaser’s obligations under this Agreement’ subject to a specific Limited Guaranty agreement.

Who are those eight companies and what do we know about them:

- Madrone Partners, LP, Madrone Opportunity Fund, LP and Shimoda Holdings LLC,

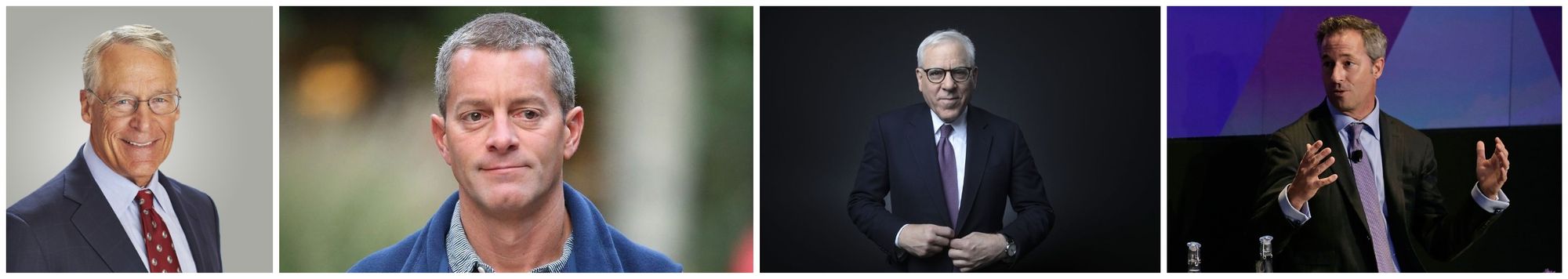

These three entities are private equity firms linked to Rob Walton, the eldest son of Sam Walton, the founder of US-based supermarket empire Wal-mart. Rob Walton’s wealth is estimated to be in excess of USD55 billion and Wal-mart generated more than USD515 billion in revenues last year. In a 2015 SEC filing, the manager of a number of these entities, including Shimoda Holdings, LLC, was listed as Gregory Penner, or Greg Penner. Penner is the son-in-law of Rob Walton and has served as chairman of Wal-mart, the company his grandfather-in-law founded, for almost five years.

This is Bloomberg’s live reporting from 2015 of the announcement that the chairmanship of Wal-mart was being passed from father-in-law to son-in-law.

Both Penner and Eric Baker, Viagogo founder and CEO [and cofounder of StubHub in 2000] attended Stanford’s Business School but at different times.

Here is Baker who graduated with his MBA in 2001, telling the Stanford Graduate School of Business, the very first inkling he had about the secondary ticket market:

‘While enrolled at Stanford GSB, Baker investigated selling his tickets for a big Los Angeles Lakers basketball game that he couldn't attend. Posing as a customer wanting to buy a ticket for the game, he called a ticket broker and was quoted prices between USD1,500 and USD1,800. Later, Baker called back offering to sell his ticket; the broker offered to pay only USD1,000. “Clearly, there was an opportunity," Baker said.’

- Bessemer Ventures Partners Century Fund Institutional L.P., Bessemer Venture Partners Century Fund L.P., Bessemer Venture Partners VS, L.P.

Kudos to BVP: the websites of VC firms normally gush endlessly about the companies they picked that were winners, and there is plenty of that on their website But their website also includes what they call their ‘anti-portfolio’: the companies that approached them at various stages of growth and which BVP rejected. It’s quite a list, including Google, Airbnb, Apple and Facebook. One of the companies that also approached them was, ironically, eBay. The company’s response: ‘Stamps? Coins? Comic books? You’ve GOT to be kidding me. No brainer pass’ said BVP’s David Cowan, who would, of course, redeem himself many times over with other investments, including Twitch.

This is a one-hour plus but very interesting interview with Cowan last month. It covers a multitude of topics from his experience in tech VC and why he is happy to own his mistakes through the ‘anti-portfolio’ listing.

- Declaration Capital LLC

Declaration describes itself as making private equity and real estate investments, including building platform businesses, providing growth equity capital, seeding early stage private funds and venture studios, and partnering with family-owned businesses.

Reporting by the Wall Street Journal [behind a paywall] says that in order to play their part in the StubHub acquisition an adviser to the Declaration entities had to register with the SEC allowing it to raise outside capital.‘Declaration registered to raise outside money so that it could invest in Viagogo Entertainment Inc.’s buy of eBay Inc.’s StubHub business for $4.05 billion, a deal that created a global ticketing giant. That deal closed in February, the same month Declaration’s registration became effective. Viagogo was among Declaration’s earliest investments and the firm increased its stake to help finance the deal, bringing on board other investors including family offices, said a person familiar with the matter.’

The WSJ reports that Declaration first invested in Viagogo on October 2017 and their contribution to Viagogo’s purchase price of US$ 4 billion from Rubenstein’s funds and other is estimated to be US$ 200 million.

- WestCap Management, LLC

This is a growth equity firm originally founded by Laurence Tosi over 25 years ago as Weston Capital. WestCap has over US $1 billion in assets under management. The firm focuses on growth-stage technology businesses in Fintech, real estate tech, healthcare tech and ‘asset-light marketplace platforms’, all areas where the WestCap team has both operated and invested. Notable investments to date include Airbnb, Point Financial, Sonder, Blueground, Skillz, Addepar and Viagogo. After making an initial investment in Viagogo in early 2019, WestCap co-led viagago's acquisition of Stubhub in November 2019.

Laurence Tosi was the CFO of Airbnb for almost three years until February 2018 and before that was CFO of The Blackstone Group. This is how CNBC covered Tosi’s departure from Airbnb where he was described as the only adult in the room amongst the company’s young founders.In this humble writer’s opinion, a pertinent fact about Tosi is that he sold his two-bedroom apartment in New York’s Soho to screenwriter Paul Haggis. Who? Haggis has many credits to his name including the screenplay to Million Dollar Baby, but he also penned the immortal line in Casino Royale for the sultry Vesper Lynd: ‘There are dinner jackets and dinner jackets; this is the latter,’ before presenting James Bond with a most superlative dinner jacket tailored impeccably to his size.

2. The ‘Kill Fee’

On February 13 this year, Viagogo sent out a formal press release saying that the company had closed on their purchase of StubHub from eBay.There are two ‘kill fees’ referenced in the agreement, a Purchaser Termination Fee of US$ 200 million if Viagogo does not go through with the purchase for a series of reasons outlined.

And a Regulatory Termination Fee, also of USD200 million under 9.3 c).

The full text is worth reading here because of the ongoing investigation by the UK market regulator that The DAIMANI Journal has been following closely.

(c) Purchaser shall pay to Parent (or Parent’s designee) two hundred million dollars ($200,000,000.00) (the “Regulatory Termination Fee”) if this Agreement is terminated pursuant to Section 9.1(b)(i) or Section 9.1(b)(iii) (to the extent that the Legal Restraint is in respect of a consent, authorization or approval required under Section 8.1(a) or is a Legal Restraint issued or enacted by a competition or antitrust authority or arising under any Competition Laws) and, at the time of such termination, (A) the condition set forth in Section 8.1(a) or Section 8.1(b) (to the extent that the Legal Restraint is in respect of a consent, authorization or approval required under Section 8.1(a) or is a Legal Restraint issued or enacted by a competition or antitrust authority or arising under any Competition Laws) has not been satisfied and (B) all of the conditions to the Closing, other than the conditions set forth in Section 8.1(a) or Section 8.1(b) (to the extent that the Legal Restraint is in respect of a consent, authorization or approval required under Section 8.1(a) or is a Legal Restraint issued or enacted by a competition or antitrust authority or arising under any Competition Laws), have been satisfied (or in the case of conditions that by their nature are to be satisfied at the Closing, are capable of being satisfied if the Closing were to occur on the date of such termination) or waived; provided, that no Regulatory Termination Fee shall be payable by Purchaser pursuant to this Section 9.3(c) if the failure of the condition set forth in Section 8.1(a) or Section 8.1(b) (to the extent that the Legal Restraint is in respect of a consent, authorization or approval required under Section 8.1(a) or is a Legal Restraint issued or enacted by a competition or antitrust authority or arising under any Competition Laws) to be satisfied is caused by Parent’s Willful Breach of Section 5.3.

Wiser minds than that of this writer’s will make of this what they will – whether Viagogo pressing to close the deal so quickly [the Purchaser Termination Fee provided for up to 12 months from late November 2019 to close on the purchase].

The viability of this purchase stands to be judged not by conditions in November 2019 or February 2020: The Live Event market has gone into an unparalleled global lockdown, the WHO declaring a pandemic less than 30 days after the StubHub purchased closed. Plus the UK market regulator seems ready to take the ‘Stubagogo’ deal to the mat – with the UK being the second most significant market for the combined entities.

3. Non-compete

Under the terms of this agreement, 5.16 c) eBay has agreed in principle not to create a rival business to that of ‘Stubagogo’ for three years from the end of November 2019 subject only to these three main carveouts:

(c) For a period of three (3) years following the Closing Date, without the prior written consent of Purchaser, Parent and its Subsidiaries shall not engage, or agree to engage, in any Business Territory, in the business or operation of an online ticket exchange for buyers and sellers of tickets for sports, concerts, theater and other live entertainment events (a “Competing Business”); provided, that nothing in this Agreement shall restrict Parent or its Subsidiaries at any time from:

(i) owning or acquiring ten percent (10%) or less of the outstanding securities of any Person, owning or acquiring securities held as investments of any pension fund or employee benefit plan of Parent, or investing in any fund in which the Sellers and their respective Subsidiaries have no discretion with respect to the investment strategy of such fund (a “De Minimis Investment”);

(ii) acquiring and, after such acquisition, owning an interest in any Person or business that is engaged in a Competing Business, other than a De Minimis Investment, and operating such Competing Business, if such Competing Business generated less than twenty five percent (25%) of such Person’s consolidated annual revenues in the last completed fiscal year;

(iii) entering into or participating in a joint venture, partnership or other strategic business relationship with any Person engaged in a Competing Business, if such joint venture, partnership or other strategic business relationship does not directly or indirectly engage in the Competing Business;